Page 64 - Azerbaijan State University of Economics

P. 64

N.V. Abdullayeva: Value creation through mergers and acquisitions in energy sector

better performance by access to new markets, increase in market share, economies of

scale and scope as well as cost savings. Energy companies choose horizontal type of

merge to increase the leadership and market share through combining costly cutting

edge technology and professions expertise.

b. Vertical Merger - when two companies in the same industry but in different fields

of chain value combine together in business. In other words, when the target is from

different production line, for instance supplier or customer, and thus vertical merger gives

the acquirer an access to complementary resources. In this form, the companies in merger

decide to combine all the operations and production under one shelter. Vertical Merger

and Acquisition can be either upstream (backward) or downstream (forward). Rationale

for energy companies to use upstream is to ensure constant supply.

c. Conglomerate Merger - when bidder belongs to entirely different type of

business activity than the target company. Firms utilize conglomerate type of M&A

as a means of diversification. Many conglomerate failed to be successful, one of the

most successful one is General Electric built by Jack Welch.

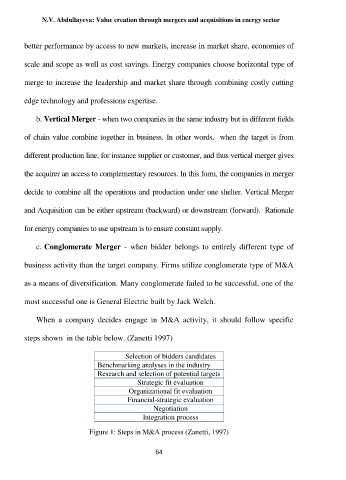

When a company decides engage in M&A activity, it should follow specific

steps shown in the table below. (Zanetti 1997)

Selection of bidders candidates

Benchmarking analyses in the industry

Research and selection of potential targets

Strategic fit evaluation

Organizational fit evaluation

Financial-strategic evaluation

Negotiation

Integration process

Figure 1: Steps in M&A process (Zanetti, 1997)

64