Page 26 - Azerbaijan State University of Economics

P. 26

THE JOURNAL OF ECONOMIC SCIENCES: THEORY AND PRACTICE, V.76, # 1, 2019, pp. 20-33

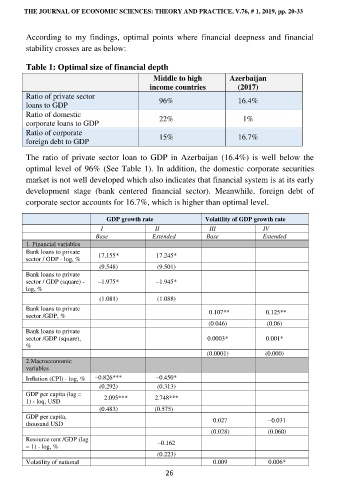

According to my findings, optimal points where financial deepness and financial

stability crosses are as below:

Table 1: Optimal size of financial depth

Middle to high Azerbaijan

income countries (2017)

Ratio of private sector 96% 16.4%

loans to GDP

Ratio of domestic 22% 1%

corporate loans to GDP

Ratio of corporate

foreign debt to GDP 15% 16.7%

The ratio of private sector loan to GDP in Azerbaijan (16.4%) is well below the

optimal level of 96% (See Table 1). In addition, the domestic corporate securities

market is not well developed which also indicates that financial system is at its early

development stage (bank centered financial sector). Meanwhile, foreign debt of

corporate sector accounts for 16.7%, which is higher than optimal level.

GDP growth rate Volatility of GDP growth rate

I II III IV

Base Extended Base Extended

1. Financial variables

Bank loans to private 17.155* 17.245*

sector / GDP - log, %

(9.548) (9.501)

Bank loans to private

sector / GDP (square) - –1.975* –1.945*

log, %

(1.081) (1.088)

Bank loans to private –0.107** –0.125**

sector /GDP, %

(0.046) (0.06)

Bank loans to private

sector /GDP (square), 0.0003* 0.001*

%

(0.0001) (0.000)

2.Macroeconomic

variables

Inflation (CPI) - log, % –0.826*** –0.450*

(0.292) (0.313)

GDP per capita (lag =

1) - loq, USD –2.095*** –2.748***

(0.483) (0.575)

GDP per capita, 0.027 –0.031

thousand USD

(0.028) (0.060)

Resource rent /GDP (lag –0.162

= 1) - log, %

(0.223)

Volatility of national 0.009 0.006*

26