Page 25 - Azerbaijan State University of Economics

P. 25

THE JOURNAL OF ECONOMIC SCIENCES: THEORY AND PRACTICE, V.76, # 2, 2019, pp. 21-30

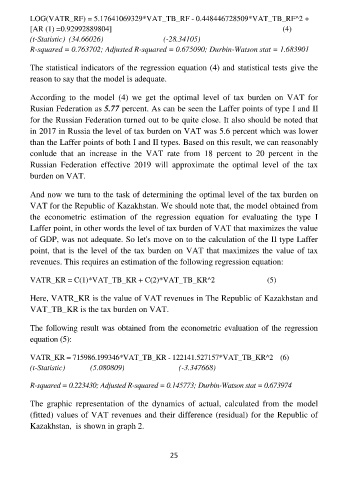

LOG(VATR_RF) = 5.17641069329*VAT_TB_RF - 0.448446728509*VAT_TB_RF^2 +

[AR (1) =0.92992889804] (4)

(t-Statistic) (34.66026) (-28.34105)

R-squared = 0.763702; Adjusted R-squared = 0.675090; Durbin-Watson stat = 1.683901

The statistical indicators of the regression equation (4) and statistical tests give the

reason to say that the model is adequate.

According to the model (4) we get the optimal level of tax burden on VAT for

Rusian Federation as 5.77 percent. As can be seen the Laffer points of type I and II

for the Russian Federation turned out to be quite close. It also should be noted that

in 2017 in Russia the level of tax burden on VAT was 5.6 percent which was lower

than the Laffer points of both I and II types. Based on this result, we can reasonably

conlude that an increase in the VAT rate from 18 percent to 20 percent in the

Russian Federation effective 2019 will approximate the optimal level of the tax

burden on VAT.

And now we turn to the task of determining the optimal level of the tax burden on

VAT for the Republic of Kazakhstan. We should note that, the model obtained from

the econometric estimation of the regression equation for evaluating the type I

Laffer point, in other words the level of tax burden of VAT that maximizes the value

of GDP, was not adequate. So let's move on to the calculation of the II type Laffer

point, that is the level of the tax burden on VAT that maximizes the value of tax

revenues. This requires an estimation of the following regression equation:

VATR_KR = C(1)*VAT_TB_KR + C(2)*VAT_TB_KR^2 (5)

Here, VATR_KR is the value of VAT revenues in The Republic of Kazakhstan and

VAT_TB_KR is the tax burden on VAT.

The following result was obtained from the econometric evaluation of the regression

equation (5):

VATR_KR = 715986.199346*VAT_TB_KR - 122141.527157*VAT_TB_KR^2 (6)

(t-Statistic) (5.080809) (-3.347668)

R-squared = 0.223430; Adjusted R-squared = 0.145773; Durbin-Watson stat = 0.673974

The graphic representation of the dynamics of actual, calculated from the model

(fitted) values of VAT revenues and their difference (residual) for the Republic of

Kazakhstan, is shown in graph 2.

25