Page 89 - Azerbaijan State University of Economics

P. 89

54. Fakhri Mammadov: Exchange Rate Stabılıty and the Development of Fınancıal System

55. in Azerbaıjan

56.

57.

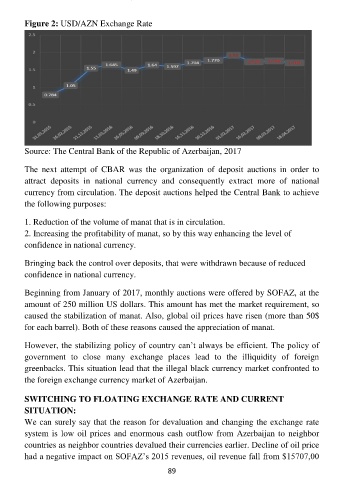

Figure 2: USD/AZN Exchange Rate

Source: The Central Bank of the Republic of Azerbaijan, 2017

The next attempt of CBAR was the organization of deposit auctions in order to

attract deposits in national currency and consequently extract more of national

currency from circulation. The deposit auctions helped the Central Bank to achieve

the following purposes:

1. Reduction of the volume of manat that is in circulation.

2. Increasing the profitability of manat, so by this way enhancing the level of

confidence in national currency.

Bringing back the control over deposits, that were withdrawn because of reduced

confidence in national currency.

Beginning from January of 2017, monthly auctions were offered by SOFAZ, at the

amount of 250 million US dollars. This amount has met the market requirement, so

caused the stabilization of manat. Also, global oil prices have risen (more than 50$

for each barrel). Both of these reasons caused the appreciation of manat.

However, the stabilizing policy of country can’t always be efficient. The policy of

government to close many exchange places lead to the illiquidity of foreign

greenbacks. This situation lead that the illegal black currency market confronted to

the foreign exchange currency market of Azerbaijan.

SWITCHING TO FLOATING EXCHANGE RATE AND CURRENT

SITUATION:

We can surely say that the reason for devaluation and changing the exchange rate

system is low oil prices and enormous cash outflow from Azerbaijan to neighbor

countries as neighbor countries devalued their currencies earlier. Decline of oil price

had a negative impact on SOFAZ’s 2015 revenues, oil revenue fall from $15707,00

89