Page 22 - Azerbaijan State University of Economics

P. 22

Murad Y. Yusıfov: Econometrıc Assessment Of Optımal Interest Burden: Case Study For Azerbaıjan

(International Monetary Fund, GFSM, 2014; Xavier and Tidiane, 2013). K.Torstensen

defined the interest burden as interest expenses after tax as a percentage of disposable

income plus interest expenses after tax. The interest burden impacts the volume of

household income which is available for consumption (Kjersti, 2016). According to

Guariglia Alessandra, Spaliara Marina-Eliza and Tsoukas Serafeim, a higher interest

burden exposes the company to the higher interest costs (Guariglia et al., 2015). The

growth of the interest burden affects the level of GDP in the real sector. As a result,

the interest expenses debited to the enterprise's expense accounts exerts pressure on

the enterprise's net profit, wages and social security contributions and consequently,

at the same time it causes the reduction of tax revenues.

As a generalized indicator at the macroeconomic level, the interest burden was defined

by D.Rodgers as the ratio of accrued interest to GDP. At the enterprise level, the

interest burden is defined as the ratio of interest expenses to interest and pre-tax

earnings (EBIT) (David, 2015). Jaroslav Sedlacek and Daniel Nemec determined the

company's interest burden as EBT / EBIT (Sedláček & Nemec, 2018).

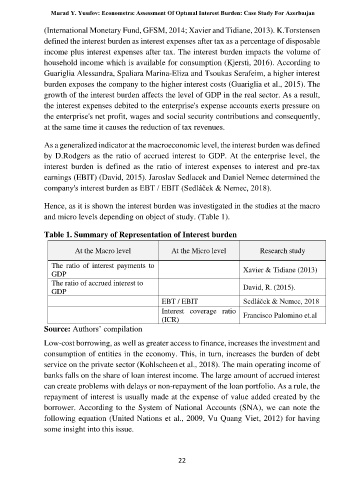

Hence, as it is shown the interest burden was investigated in the studies at the macro

and micro levels depending on object of study. (Table 1).

Table 1. Summary of Representation of Interest burden

At the Macro level At the Micro level Research study

The ratio of interest payments to

GDP Xavier & Tidiane (2013)

The ratio of accrued interest to David, R. (2015).

GDP

EBT / EBIT Sedláček & Nemec, 2018

Interest coverage ratio

Francisco Palomino et.al

(ICR)

Source: Authors’ compilation

Low-cost borrowing, as well as greater access to finance, increases the investment and

consumption of entities in the economy. This, in turn, increases the burden of debt

service on the private sector (Kohlscheen et al., 2018). The main operating income of

banks falls on the share of loan interest income. The large amount of accrued interest

can create problems with delays or non-repayment of the loan portfolio. As a rule, the

repayment of interest is usually made at the expense of value added created by the

borrower. According to the System of National Accounts (SNA), we can note the

following equation (United Nations et al., 2009, Vu Quang Viet, 2012) for having

some insight into this issue.

22