Page 47 - Azerbaijan State University of Economics

P. 47

S.A.Najafov: Debt rigidity crisis

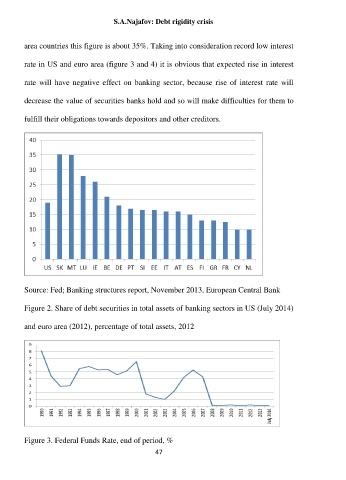

area countries this figure is about 35%. Taking into consideration record low interest

rate in US and euro area (figure 3 and 4) it is obvious that expected rise in interest

rate will have negative effect on banking sector, because rise of interest rate will

decrease the value of securities banks hold and so will make difficulties for them to

fulfill their obligations towards depositors and other creditors.

Source: Fed; Banking structures report, November 2013, European Central Bank

Figure 2. Share of debt securities in total assets of banking sectors in US (July 2014)

and euro area (2012), percentage of total assets, 2012 sha of debt securities in total

Figure 3. Federal Funds Rate, end of period, %

47