Page 48 - Azerbaijan State University of Economics

P. 48

THE JOURNAL OF ECONOMIC SCIENCES: THEORY AND PRACTICE, V.72, # 1, 2015, pp. 40-49

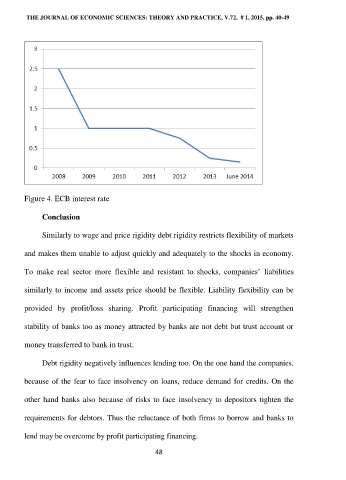

Figure 4. ECB interest rate

Conclusion

Similarly to wage and price rigidity debt rigidity restricts flexibility of markets

and makes them unable to adjust quickly and adequately to the shocks in economy.

To make real sector more flexible and resistant to shocks, companies‘ liabilities

similarly to income and assets price should be flexible. Liability flexibility can be

provided by profit/loss sharing. Profit participating financing will strengthen

stability of banks too as money attracted by banks are not debt but trust account or

money transferred to bank in trust.

Debt rigidity negatively influences lending too. On the one hand the companies,

because of the fear to face insolvency on loans, reduce demand for credits. On the

other hand banks also because of risks to face insolvency to depositors tighten the

requirements for debtors. Thus the reluctance of both firms to borrow and banks to

lend may be overcome by profit participating financing.

48