Page 72 - Azerbaijan State University of Economics

P. 72

THE JOURNAL OF ECONOMIC SCIENCES: THEORY AND PRACTICE, V.71, # 2, 2014, pp. 66-80

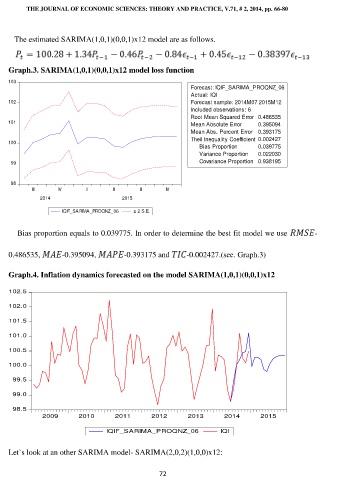

The estimated SARIMA(1,0,1)(0,0,1)x12 model are as follows.

Graph.3. SARIMA(1,0,1)(0,0,1)x12 model loss function

103

Forecast: IQIF_SARIMA_PROQNZ_06

Actual: IQI

102 Forecast sample: 2014M07 2015M12

Included observations: 6

Root Mean Squared Error 0.486535

101 Mean Absolute Error 0.395094

Mean Abs. Percent Error 0.393175

Theil Inequality Coefficient 0.002427

100

Bias Proportion 0.039775

Variance Proportion 0.022030

99 Covariance Proportion 0.938195

98

III IV I II III IV

2014 2015

IQIF_SARIMA_PROQNZ_06 ± 2 S.E.

Bias proportion equals to 0.039775. In order to determine the best fit model we use -

0.486535, -0.395094, -0.393175 and -0.002427.(see. Graph.3)

Graph.4. Inflation dynamics forecasted on the model SARIMA(1,0,1)(0,0,1)x12

102.5

102.0

101.5

101.0

100.5

100.0

99.5

99.0

98.5

2009 2010 2011 2012 2013 2014 2015

IQIF_SARIMA_PROQNZ_06 IQI

Let`s look at an other SARIMA model- SARIMA(2,0,2)(1,0,0)x12:

72