Page 74 - Azerbaijan State University of Economics

P. 74

THE JOURNAL OF ECONOMIC SCIENCES: THEORY AND PRACTICE, V.71, # 2, 2014, pp. 66-80

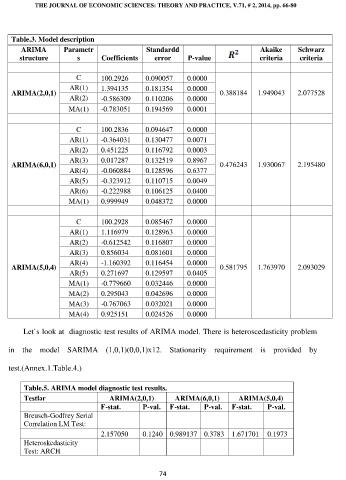

Table.3. Model description

ARIMA Parametr Standardd Akaike Schwarz

structure s Coefficients error P-value criteria criteria

C 100.2926 0.090057 0.0000

AR(1) 1.394135 0.181354 0.0000

ARIMA(2,0,1) 0.388184 1.949043 2.077528

AR(2) -0.586309 0.110206 0.0000

MA(1) -0.783051 0.194569 0.0001

C 100.2836 0.094647 0.0000

AR(1) -0.364031 0.130477 0.0071

AR(2) 0.451225 0.116792 0.0003

AR(3) 0.017287 0.132519 0.8967

ARIMA(6,0,1) 0.476243 1.930067 2.195480

AR(4) -0.060884 0.128596 0.6377

AR(5) -0.323912 0.110715 0.0049

AR(6) -0.222988 0.106125 0.0400

MA(1) 0.999949 0.048372 0.0000

C 100.2928 0.085467 0.0000

AR(1) 1.116979 0.128963 0.0000

AR(2) -0.612542 0.116807 0.0000

AR(3) 0.856034 0.081601 0.0000

AR(4) -1.160392 0.116454 0.0000

ARIMA(5,0,4) 0.581795 1.763970 2.093029

AR(5) 0.271697 0.129597 0.0405

MA(1) -0.779660 0.032446 0.0000

MA(2) 0.295043 0.042696 0.0000

MA(3) -0.767063 0.032021 0.0000

MA(4) 0.925151 0.024526 0.0000

Let`s look at diagnostic test results of ARIMA model. There is heteroscedasticity problem

in the model SARIMA (1,0,1)(0,0,1)x12. Stationarity requirement is provided by

test.(Annex.1.Table.4.)

Table.5. ARIMA model diagnostic test results.

Testlər ARIMA(2,0,1) ARIMA(6,0,1) ARIMA(5,0,4)

F-stat. P-val. F-stat. P-val. F-stat. P-val.

Breusch-Godfrey Serial

Correlation LM Test:

2.157050 0.1240 0.989137 0.3783 1.671701 0.1973

Heteroskedasticity

Test: ARCH

74