Page 27 - Azerbaijan State University of Economics

P. 27

Hashim Al-Ali: Towards a realistic medium term macroeconomic and fiscal framework and

outlook for the Somali national economy (2017- 2019)

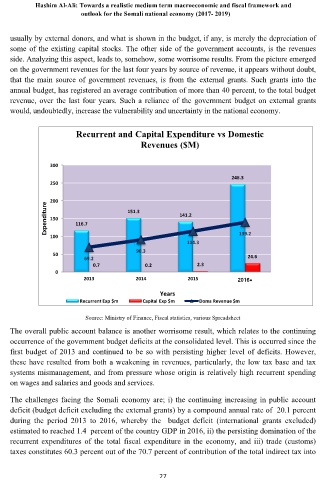

usually by external donors, and what is shown in the budget, if any, is merely the depreciation of

some of the existing capital stocks. The other side of the government accounts, is the revenues

side. Analyzing this aspect, leads to, somehow, some worrisome results. From the picture emerged

on the government revenues for the last four years by source of revenue, it appears without doubt,

that the main source of government revenues, is from the external grants. Such grants into the

annual budget, has registered an average contribution of more than 40 percent, to the total budget

revenue, over the last four years. Such a reliance of the government budget on external grants

would, undoubtedly, increase the vulnerability and uncertainty in the national economy.

Recurrent and Capital Expenditure vs Domestic

Revenues ($M)

300

246.3

250

200

151.3 141.2

Expenditure 150 116.7

100 139.2

114.3

90.3

50 24.6

69.2

0.7 0.2 2.3

0 2013 2014 2015

2016*

Years

Recurrent Exp $m Capital Exp $m Doms Revenue $m

Source: Ministry of Finance, Fiscal statistics, various Spreadsheet

The overall public account balance is another worrisome result, which relates to the continuing

occurrence of the government budget deficits at the consolidated level. This is occurred since the

first budget of 2013 and continued to be so with persisting higher level of deficits. However,

these have resulted from both a weakening in revenues, particularly, the low tax base and tax

systems mismanagement, and from pressure whose origin is relatively high recurrent spending

on wages and salaries and goods and services.

The challenges facing the Somali economy are; i) the continuing increasing in public account

deficit (budget deficit excluding the external grants) by a compound annual rate of 20.1 percent

during the period 2013 to 2016, whereby the budget deficit (international grants excluded)

estimated to reached 1.4 percent of the country GDP in 2016, ii) the persisting domination of the

recurrent expenditures of the total fiscal expenditure in the economy, and iii) trade (customs)

taxes constitutes 60.3 percent out of the 70.7 percent of contribution of the total indirect tax into

27