Page 14 - Azerbaijan State University of Economics

P. 14

THE JOURNAL OF ECONOMIC SCIENCES: THEORY AND PRACTICE, V.78, # 2, 2021, pp. 4-16

It should be noted that the study examined the normal and exponential distribution of

the scores collected by applicant in all specialty groups for both Azerbaijani and Russian

sections, as well as the scores obtained by bachelors in the admission exams to master

level. However, the results for all of these groups are subject to neither normal nor

exponential distribution. That is to say that the scores are assymmetrically distributed.

As it can be seen from tables 2 and 3 in both cases the mean of sequence is greater

than its mod, and this means that these sequences are asymmetric to the right.

ECONOMETRIC EVALUATION OF SCORES OBTAINED IN THE

ADMISSION EXAMS

Evaluation of the dependence of average scores on time. An econometric evaluation

was made of the dependence of the average scores obtained by the applicants from

time. For this, the following specification of the regression equation was considered:

Log(mean_total)=c(1)+ c(2) @TREND (2)

The result of the econometric evaluation of the regression equation in the EViews

application package (Eviews 9) was as follows:

LOG(MEAN_TOTAL) = 5.1093116842 + 0.0101236457358*@TREND (3)

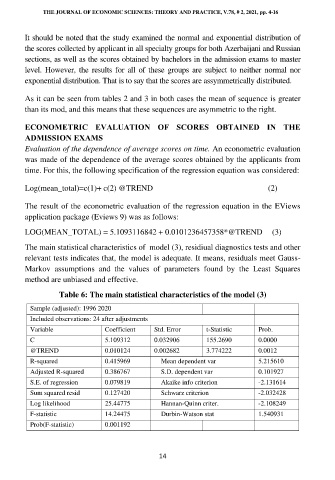

The main statistical characteristics of model (3), residiual diagnostics tests and other

relevant tests indicates that, the model is adequate. It means, residuals meet Gauss-

Markov assumptions and the values of parameters found by the Least Squares

method are unbiased and effective.

Table 6: The main statistical characteristics of the model (3)

Sample (adjusted): 1996 2020

Included observations: 24 after adjustments

Variable Coefficient Std. Error t-Statistic Prob.

C 5.109312 0.032906 155.2690 0.0000

@TREND 0.010124 0.002682 3.774222 0.0012

R-squared 0.415969 Mean dependent var 5.215610

Adjusted R-squared 0.386767 S.D. dependent var 0.101927

S.E. of regression 0.079819 Akaike info criterion -2.131614

Sum squared resid 0.127420 Schwarz criterion -2.032428

Log likelihood 25.44775 Hannan-Quinn criter. -2.108249

F-statistic 14.24475 Durbin-Watson stat 1.540931

Prob(F-statistic) 0.001192

14