Page 21 - Azerbaijan State University of Economics

P. 21

THE JOURNAL OF ECONOMIC SCIENCES: THEORY AND PRACTICE, V.78, # 2, 2021, pp. 17-42

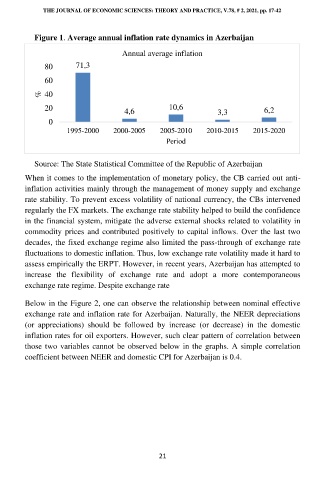

Figure 1. Average annual inflation rate dynamics in Azerbaijan

Annual average inflation

80 71,3

60

% 40

20 4,6 10,6 3,3 6,2

0

1995-2000 2000-2005 2005-2010 2010-2015 2015-2020

Period

Source: The State Statistical Committee of the Republic of Azerbaijan

When it comes to the implementation of monetary policy, the CB carried out anti-

inflation activities mainly through the management of money supply and exchange

rate stability. To prevent excess volatility of national currency, the CBs intervened

regularly the FX markets. The exchange rate stability helped to build the confidence

in the financial system, mitigate the adverse external shocks related to volatility in

commodity prices and contributed positively to capital inflows. Over the last two

decades, the fixed exchange regime also limited the pass-through of exchange rate

fluctuations to domestic inflation. Thus, low exchange rate volatility made it hard to

assess empirically the ERPT. However, in recent years, Azerbaijan has attempted to

increase the flexibility of exchange rate and adopt a more contemporaneous

exchange rate regime. Despite exchange rate

Below in the Figure 2, one can observe the relationship between nominal effective

exchange rate and inflation rate for Azerbaijan. Naturally, the NEER depreciations

(or appreciations) should be followed by increase (or decrease) in the domestic

inflation rates for oil exporters. However, such clear pattern of correlation between

those two variables cannot be observed below in the graphs. A simple correlation

coefficient between NEER and domestic CPI for Azerbaijan is 0.4.

21