Page 25 - Azerbaijan State University of Economics

P. 25

THE JOURNAL OF ECONOMIC SCIENCES: THEORY AND PRACTICE, V.78, # 2, 2021, pp. 17-42

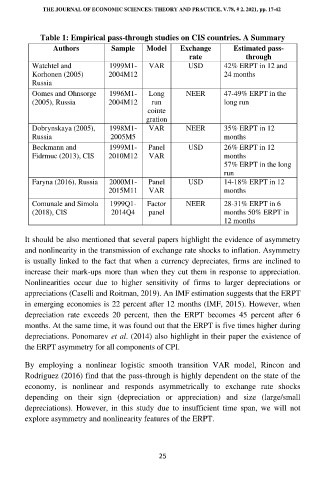

Table 1: Empirical pass-through studies on CIS countries. A Summary

Authors Sample Model Exchange Estimated pass-

rate through

Watchtel and 1999M1- VAR USD 42% ERPT in 12 and

Korhonen (2005) 2004M12 24 months

Russia

Oomes and Ohnsorge 1996M1- Long NEER 47-49% ERPT in the

(2005), Russia 2004M12 run long run

cointe

gration

Dobrynskaya (2005), 1998M1- VAR NEER 35% ERPT in 12

Russia 2005M5 months

Beckmann and 1999M1- Panel USD 26% ERPT in 12

Fidrmuc (2013), CIS 2010M12 VAR months

57% ERPT in the long

run

Faryna (2016), Russia 2000M1- Panel USD 14-18% ERPT in 12

2015M11 VAR months

Comunale and Simola 1999Q1- Factor NEER 28-31% ERPT in 6

(2018), CIS 2014Q4 panel months 50% ERPT in

12 months

It should be also mentioned that several papers highlight the evidence of asymmetry

and nonlinearity in the transmission of exchange rate shocks to inflation. Asymmetry

is usually linked to the fact that when a currency depreciates, firms are inclined to

increase their mark-ups more than when they cut them in response to appreciation.

Nonlinearities occur due to higher sensitivity of firms to larger depreciations or

appreciations (Caselli and Roitman, 2019). An IMF estimation suggests that the ERPT

in emerging economies is 22 percent after 12 months (IMF, 2015). However, when

depreciation rate exceeds 20 percent, then the ERPT becomes 45 percent after 6

months. At the same time, it was found out that the ERPT is five times higher during

depreciations. Ponomarev et al. (2014) also highlight in their paper the existence of

the ERPT asymmetry for all components of CPI.

By employing a nonlinear logistic smooth transition VAR model, Rincon and

Rodriguez (2016) find that the pass-through is highly dependent on the state of the

economy, is nonlinear and responds asymmetrically to exchange rate shocks

depending on their sign (depreciation or appreciation) and size (large/small

depreciations). However, in this study due to insufficient time span, we will not

explore asymmetry and nonlinearity features of the ERPT.

25