Page 77 - Azerbaijan State University of Economics

P. 77

THE JOURNAL OF ECONOMIC SCIENCES: THEORY AND PRACTICE, V.79, # 1, 2022, pp. 69-79

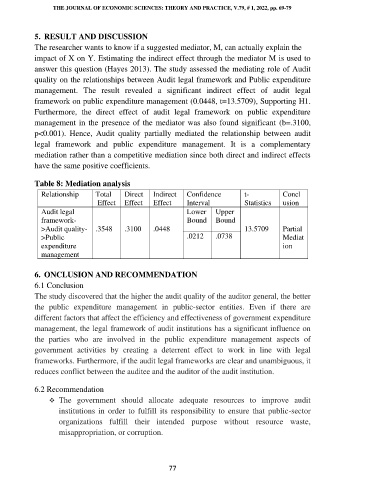

5. RESULT AND DISCUSSION

The researcher wants to know if a suggested mediator, M, can actually explain the

impact of X on Y. Estimating the indirect effect through the mediator M is used to

answer this question (Hayes 2013). The study assessed the mediating role of Audit

quality on the relationships between Audit legal framework and Public expenditure

management. The result revealed a significant indirect effect of audit legal

framework on public expenditure management (0.0448, t=13.5709), Supporting H1.

Furthermore, the direct effect of audit legal framework on public expenditure

management in the presence of the mediator was also found significant (b=.3100,

p<0.001). Hence, Audit quality partially mediated the relationship between audit

legal framework and public expenditure management. It is a complementary

mediation rather than a competitive mediation since both direct and indirect effects

have the same positive coefficients.

Table 8: Mediation analysis

Relationship Total Direct Indirect Confidence t- Concl

Effect Effect Effect Interval Statistics usion

Audit legal Lower Upper

framework- Bound Bound

>Audit quality- .3548 .3100 .0448 13.5709 Partial

>Public .0212 .0738 Mediat

expenditure ion

management

6. ONCLUSION AND RECOMMENDATION

6.1 Conclusion

The study discovered that the higher the audit quality of the auditor general, the better

the public expenditure management in public-sector entities. Even if there are

different factors that affect the efficiency and effectiveness of government expenditure

management, the legal framework of audit institutions has a significant influence on

the parties who are involved in the public expenditure management aspects of

government activities by creating a deterrent effect to work in line with legal

frameworks. Furthermore, if the audit legal frameworks are clear and unambiguous, it

reduces conflict between the auditee and the auditor of the audit institution.

6.2 Recommendation

❖ The government should allocate adequate resources to improve audit

institutions in order to fulfill its responsibility to ensure that public-sector

organizations fulfill their intended purpose without resource waste,

misappropriation, or corruption.

77