Page 110 - Azerbaijan State University of Economics

P. 110

THE JOURNAL OF ECONOMIC SCIENCES: THEORY AND PRACTICE, V.80, # 1, 2023, pp. 106-118

Analytical model

The models logit, probit, discriminant analysis, and regression models can all be used

to analyze quantitative data. When the dependent variable is binary, the models of

logit, probit, and discriminant analysis are appropriate. B. Muthen and L. Muthen,

(2007) advised using a regression model for this type of investigation because the

dependent variable is continuous. Return on Equity was used to clearly evaluate the

performance of the company (Y).

Y =α +β1x1+β2X2+ β 3X3 + ε

Where,

Y = Profitability as measured by Return on Equity of the company

X1 = Change in assets as measured by Asset Growth ratio

X2 = Financial Leverage of the company as measured by the debt to equity ratio

X3= Liquidity as measured by Current ratio of the company.

α = The Intercept or constant

β1…. β3 = the regression coefficients of the independent variables.

ε = Error term

Empirical Study and Discussion

Descriptive statistics

The study determined that it was first necessary to assess the performance of the firms

via investment decision variables under consideration, i.e., liquidity as measured by

the company's current assets to current liabilities ratio, financial leverage as measured

by the debt to equity ratio and change in assets as measured by asset growth ratio. As

shown in Table 1, their mean, standard deviation, lowest and maximum values were

calculated.

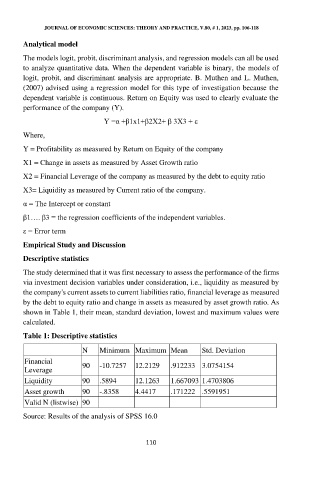

Table 1: Descriptive statistics

N Minimum Maximum Mean Std. Deviation

Financial

Leverage 90 -10.7257 12.2129 .912233 3.0754154

Liquidity 90 .5894 12.1263 1.667093 1.4703806

Asset growth 90 -.8358 4.4417 .171222 .5591951

Valid N (listwise) 90

Source: Results of the analysis of SPSS 16.0

110