Page 112 - Azerbaijan State University of Economics

P. 112

THE JOURNAL OF ECONOMIC SCIENCES: THEORY AND PRACTICE, V.80, # 1, 2023, pp. 106-118

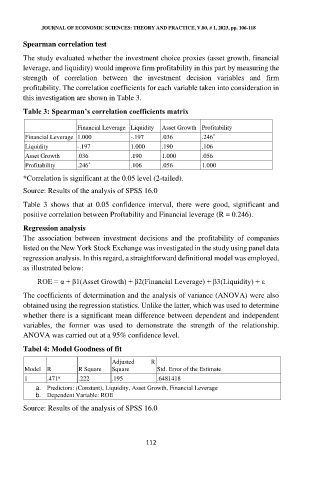

Spearman correlation test

The study evaluated whether the investment choice proxies (asset growth, financial

leverage, and liquidity) would improve firm profitability in this part by measuring the

strength of correlation between the investment decision variables and firm

profitability. The correlation coefficients for each variable taken into consideration in

this investigation are shown in Table 3.

Table 3: Spearman’s correlation coefficients matrix

Financial Leverage Liquidity Asset Growth Profitability

*

Financial Leverage 1.000 -.197 .036 .246

Liquidity -.197 1.000 .190 .106

Asset Growth .036 .190 1.000 .056

*

Profitability .246 .106 .056 1.000

*Correlation is significant at the 0.05 level (2-tailed).

Source: Results of the analysis of SPSS 16.0

Table 3 shows that at 0.05 confidence interval, there were good, significant and

positive correlation between Proftability and Financial leverage (R = 0.246).

Regression analysis

The association between investment decisions and the profitability of companies

listed on the New York Stock Exchange was investigated in the study using panel data

regression analysis. In this regard, a straightforward definitional model was employed,

as illustrated below:

ROE = α + β1(Asset Growth) + β2(Financial Leverage) + β3(Liquidity) + ε

The coefficients of determination and the analysis of variance (ANOVA) were also

obtained using the regression statistics. Unlike the latter, which was used to determine

whether there is a significant mean difference between dependent and independent

variables, the former was used to demonstrate the strength of the relationship.

ANOVA was carried out at a 95% confidence level.

Tabel 4: Model Goodness of fit

Adjusted R

Model R R Square Square Std. Error of the Estimate

a

1 .471 .222 .195 .6481418

a. Predictors: (Constant), Liquidity, Asset Growth, Financial Leverage

b. Dependent Variable: ROE

Source: Results of the analysis of SPSS 16.0

112