Page 24 - Azerbaijan State University of Economics

P. 24

Nina Poyda-Nosyk, Serhii Lehenchuk, Victoriia Makarovych, Iryna Polishchuk, Tetiana Zavalii: Analytical

Procedures in Audit As A Tool For Predicting The Risks Of Financial Statement Fraud In Marketing Companies

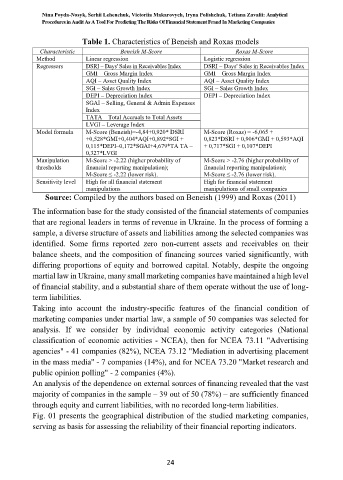

Table 1. Characteristics of Beneish and Roxas models

Characteristic Beneish M-Score Roxas M-Score

Method Linear regression Logistic regression

Regressors DSRI – Days' Sales in Receivables Index DSRI – Days' Sales in Receivables Index

GMI – Gross Margin Index GMI – Gross Margin Index

AQI – Asset Quality Index AQI – Asset Quality Index

SGI – Sales Growth Index SGI – Sales Growth Index

DEPI – Depreciation Index DEPI – Depreciation Index

SGAI – Selling, General & Admin Expenses

Index

TATA – Total Accruals to Total Assets

LVGI – Leverage Index

Model formula M-Score (Beneish)=-4,84+0,920* DSRI M-Score (Roхas) = -6,065 +

+0,528*GMI+0,404*AQI+0,892*SGI + 0,823*DSRI + 0,906*GMI + 0,593*AQI

0,115*DEPI–0,172*SGAI+4,679*TA TA – + 0,717*SGI + 0,107*DEPI

0,327*LVGI

Manipulation M-Score > -2.22 (higher probability of M-Score > -2.76 (higher probability of

thresholds financial reporting manipulation); financial reporting manipulation);

M-Score ≤ -2.22 (lower risk). M-Score ≤ -2.76 (lower risk).

Sensitivity level High for all financial statement High for financial statement

manipulations manipulations of small companies

Source: Compiled by the authors based on Beneish (1999) and Roxas (2011)

The information base for the study consisted of the financial statements of companies

that are regional leaders in terms of revenue in Ukraine. In the process of forming a

sample, a diverse structure of assets and liabilities among the selected companies was

identified. Some firms reported zero non-current assets and receivables on their

balance sheets, and the composition of financing sources varied significantly, with

differing proportions of equity and borrowed capital. Notably, despite the ongoing

martial law in Ukraine, many small marketing companies have maintained a high level

of financial stability, and a substantial share of them operate without the use of long-

term liabilities.

Taking into account the industry-specific features of the financial condition of

marketing companies under martial law, a sample of 50 companies was selected for

analysis. If we consider by individual economic activity categories (National

classification of economic activities - NCEA), then for NCEA 73.11 "Advertising

agencies" - 41 companies (82%), NCEA 73.12 "Mediation in advertising placement

in the mass media" - 7 companies (14%), and for NCEA 73.20 "Market research and

public opinion polling" - 2 companies (4%).

An analysis of the dependence on external sources of financing revealed that the vast

majority of companies in the sample – 39 out of 50 (78%) – are sufficiently financed

through equity and current liabilities, with no recorded long-term liabilities.

Fig. 01 presents the geographical distribution of the studied marketing companies,

serving as basis for assessing the reliability of their financial reporting indicators.

24