Page 135 - Azerbaijan State University of Economics

P. 135

THE JOURNAL OF ECONOMIC SCIENCES: THEORY AND PRACTICE

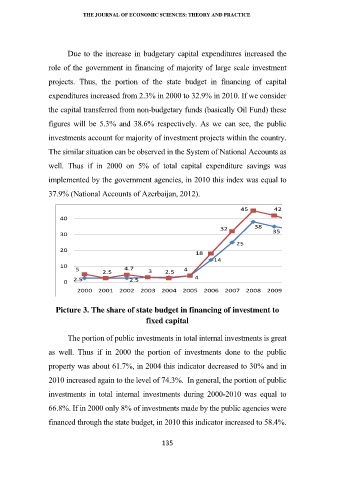

Due to the increase in budgetary capital expenditures increased the

role of the government in financing of majority of large scale investment

projects. Thus, the portion of the state budget in financing of capital

expenditures increased from 2.3% in 2000 to 32.9% in 2010. If we consider

the capital transferred from non-budgetary funds (basically Oil Fund) these

figures will be 5.3% and 38.6% respectively. As we can see, the public

investments account for majority of investment projects within the country.

The similar situation can be observed in the System of National Accounts as

well. Thus if in 2000 on 5% of total capital expenditure savings was

implemented by the government agencies, in 2010 this index was equal to

37.9% (National Accounts of Azerbaijan, 2012).

45 42

40

38

32 35

30

25

20

18

14

10

5 2.5 4.7 3 2.5 4

2.5 2.5 4

0

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009

Picture 3. The share of state budget in financing of investment to

fixed capital

The portion of public investments in total internal investments is great

as well. Thus if in 2000 the portion of investments done to the public

property was about 61.7%, in 2004 this indicator decreased to 30% and in

2010 increased again to the level of 74.3%. In general, the portion of public

investments in total internal investments during 2000-2010 was equal to

66.8%. If in 2000 only 8% of investments made by the public agencies were

financed through the state budget, in 2010 this indicator increased to 58.4%.

135