Page 131 - Azerbaijan State University of Economics

P. 131

THE JOURNAL OF ECONOMIC SCIENCES: THEORY AND PRACTICE

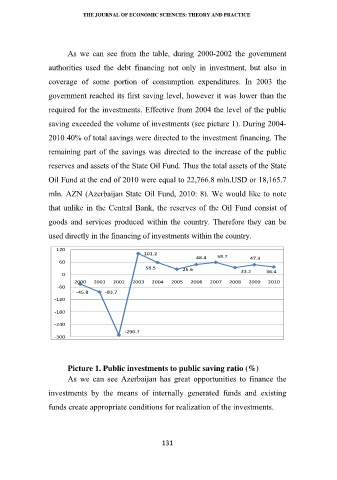

As we can see from the table, during 2000-2002 the government

authorities used the debt financing not only in investment, but also in

coverage of some portion of consumption expenditures. In 2003 the

government reached its first saving level, however it was lower than the

required for the investments. Effective from 2004 the level of the public

saving exceeded the volume of investments (see picture 1). During 2004-

2010 40% of total savings were directed to the investment financing. The

remaining part of the savings was directed to the increase of the public

reserves and assets of the State Oil Fund. Thus the total assets of the State

Oil Fund at the end of 2010 were equal to 22,766.8 mln.USD or 18,165.7

mln. AZN (Azerbaijan State Oil Fund, 2010: 8). We would like to note

that unlike in the Central Bank, the reserves of the Oil Fund consist of

goods and services produced within the country. Therefore they can be

used directly in the financing of investments within the country.

120

101.2

48.4 58.7 47.3

60

58.5 25.6

0 33.2 36.4

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

‐60

‐45.8 ‐83.7

‐120

‐180

‐240

‐290.7

‐300

Picture 1. Public investments to public saving ratio (%)

As we can see Azerbaijan has great opportunities to finance the

investments by the means of internally generated funds and existing

funds create appropriate conditions for realization of the investments.

131