Page 125 - Azerbaijan State University of Economics

P. 125

THE JOURNAL OF ECONOMIC SCIENCES: THEORY AND PRACTICE, V.82, # 2, 2025, pp. 117-137

2

2

( , , … , ) = + + ⋯ + = ∑ →

2

2

1

2

1

2

=1

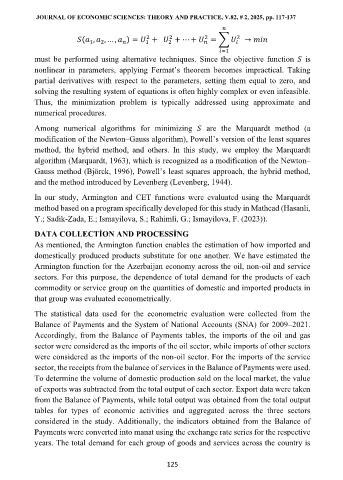

must be performed using alternative techniques. Since the objective function is

nonlinear in parameters, applying Fermat’s theorem becomes impractical. Taking

partial derivatives with respect to the parameters, setting them equal to zero, and

solving the resulting system of equations is often highly complex or even infeasible.

Thus, the minimization problem is typically addressed using approximate and

numerical procedures.

Among numerical algorithms for minimizing are the Marquardt method (a

modification of the Newton–Gauss algorithm), Powell’s version of the least squares

method, the hybrid method, and others. In this study, we employ the Marquardt

algorithm (Marquardt, 1963), which is recognized as a modification of the Newton–

Gauss method (Björck, 1996), Powell’s least squares approach, the hybrid method,

and the method introduced by Levenberg (Levenberg, 1944).

In our study, Armington and CET functions were evaluated using the Marquardt

method based on a program specifically developed for this study in Mathcad (Hasanli,

Y.; Sadik-Zada, E.; Ismayilova, S.; Rahimli, G.; Ismayilova, F. (2023)).

DATA COLLECTİON AND PROCESSİNG

As mentioned, the Armington function enables the estimation of how imported and

domestically produced products substitute for one another. We have estimated the

Armington function for the Azerbaijan economy across the oil, non-oil and service

sectors. For this purpose, the dependence of total demand for the products of each

commodity or service group on the quantities of domestic and imported products in

that group was evaluated econometrically.

The statistical data used for the econometric evaluation were collected from the

Balance of Payments and the System of National Accounts (SNA) for 2009–2021.

Accordingly, from the Balance of Payments tables, the imports of the oil and gas

sector were considered as the imports of the oil sector, while imports of other sectors

were considered as the imports of the non-oil sector. For the imports of the service

sector, the receipts from the balance of services in the Balance of Payments were used.

To determine the volume of domestic production sold on the local market, the value

of exports was subtracted from the total output of each sector. Export data were taken

from the Balance of Payments, while total output was obtained from the total output

tables for types of economic activities and aggregated across the three sectors

considered in the study. Additionally, the indicators obtained from the Balance of

Payments were converted into manat using the exchange rate series for the respective

years. The total demand for each group of goods and services across the country is

125