Page 10 - Azerbaijan State University of Economics

P. 10

THE JOURNAL OF ECONOMIC SCIENCES: THEORY AND PRACTICE, V.75, # 2, 2018, pp. 4-16

Over the entire life of Nasdaq, all 18 instances of extremely low volatility (MAPC smaller

than 0.3%), occurred during the first twenty years from 1971 to 1990. So, it is obvious

that Nasdaq has become much more volatile since 1991. In other words, those investing

in Nasdaq and the Nasdaq stocks post-1990 must learn to live with high volatility.

Looking at individual values of the monthly percentage changes, the most volatility

was experienced during April 2000 with MAPC equal to 4.3%, followed by October

2008 with 3.76%, November 2008 with 3.54%, April 2001 with 3.44%, December

2000 with 3.37% and October 1987 with 3.19% (month with the “Black Monday”).

IV. ANALYSIS OF RESULTS

Month effect: Comparison of MAPC for Each Month

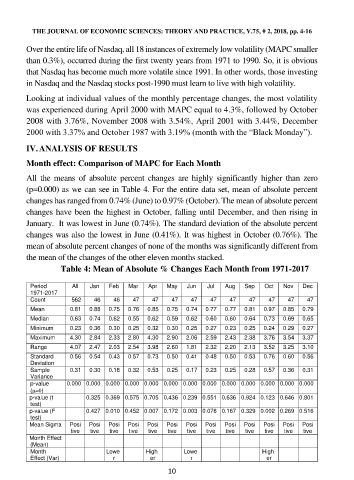

All the means of absolute percent changes are highly significantly higher than zero

(p=0.000) as we can see in Table 4. For the entire data set, mean of absolute percent

changes has ranged from 0.74% (June) to 0.97% (October). The mean of absolute percent

changes have been the highest in October, falling until December, and then rising in

January. It was lowest in June (0.74%). The standard deviation of the absolute percent

changes was also the lowest in June (0.41%). It was highest in October (0.76%). The

mean of absolute percent changes of none of the months was significantly different from

the mean of the changes of the other eleven months stacked.

Table 4: Mean of Absolute % Changes Each Month from 1971-2017

Period All Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

1971-2017

Count 562 46 46 47 47 47 47 47 47 47 47 47 47

Mean 0.81 0.88 0.75 0.76 0.85 0.75 0.74 0.77 0.77 0.81 0.97 0.85 0.79

Median 0.63 0.74 0.62 0.55 0.62 0.59 0.62 0.60 0.60 0.64 0.73 0.69 0.65

Minimum 0.23 0.36 0.30 0.25 0.32 0.30 0.25 0.27 0.23 0.25 0.24 0.29 0.27

Maximum 4.30 2.84 2.33 2.80 4.30 2.90 2.06 2.59 2.43 2.38 3.76 3.54 3.37

Range 4.07 2.47 2.03 2.54 3.98 2.60 1.81 2.32 2.20 2.13 3.52 3.25 3.10

Standard 0.56 0.54 0.43 0.57 0.73 0.50 0.41 0.48 0.50 0.53 0.76 0.60 0.56

Deviation

Sample 0.31 0.30 0.18 0.32 0.53 0.25 0.17 0.23 0.25 0.28 0.57 0.36 0.31

Variance

p-value 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000

()

p-value (t 0.325 0.369 0.575 0.705 0.436 0.239 0.551 0.636 0.924 0.123 0.646 0.801

test)

p-value (F 0.427 0.010 0.452 0.007 0.172 0.003 0.078 0.167 0.329 0.002 0.269 0.516

test)

Mean Sigma Posi Posi Posi Posi Posi Posi Posi Posi Posi Posi Posi Posi Posi

tive tive tive tive tive tive tive tive tive tive tive tive tive

Month Effect

(Mean)

Month Lowe High Lowe High

Effect (Var) r er r er

10