Page 12 - Azerbaijan State University of Economics

P. 12

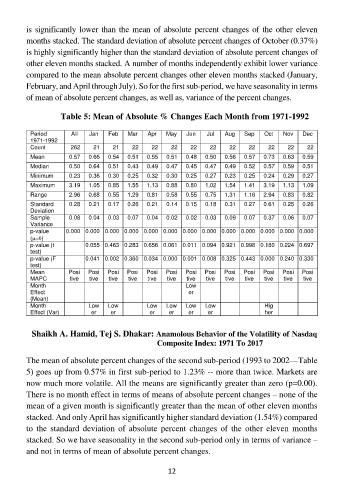

is significantly lower than the mean of absolute percent changes of the other eleven

months stacked. The standard deviation of absolute percent changes of October (0.37%)

is highly significantly higher than the standard deviation of absolute percent changes of

other eleven months stacked. A number of months independently exhibit lower variance

compared to the mean absolute percent changes other eleven months stacked (January,

February, and April through July). So for the first sub-period, we have seasonality in terms

of mean of absolute percent changes, as well as, variance of the percent changes.

Table 5: Mean of Absolute % Changes Each Month from 1971-1992

Period All Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

1971-1992

Count 262 21 21 22 22 22 22 22 22 22 22 22 22

Mean 0.57 0.66 0.54 0.51 0.55 0.51 0.48 0.50 0.56 0.57 0.73 0.63 0.59

Median 0.50 0.64 0.51 0.43 0.49 0.47 0.45 0.47 0.49 0.52 0.57 0.59 0.51

Minimum 0.23 0.36 0.30 0.25 0.32 0.30 0.25 0.27 0.23 0.25 0.24 0.29 0.27

Maximum 3.19 1.05 0.85 1.55 1.13 0.88 0.80 1.02 1.54 1.41 3.19 1.13 1.09

Range 2.96 0.68 0.55 1.29 0.81 0.58 0.55 0.75 1.31 1.16 2.94 0.83 0.82

Standard 0.28 0.21 0.17 0.26 0.21 0.14 0.15 0.18 0.31 0.27 0.61 0.25 0.26

Deviation

Sample 0.08 0.04 0.03 0.07 0.04 0.02 0.02 0.03 0.09 0.07 0.37 0.06 0.07

Variance

p-value 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000

()

p-value (t 0.055 0.463 0.283 0.656 0.061 0.011 0.094 0.921 0.998 0.180 0.224 0.697

test)

p-value (F 0.041 0.002 0.360 0.034 0.000 0.001 0.008 0.325 0.443 0.000 0.240 0.330

test)

Mean Posi Posi Posi Posi Posi Posi Posi Posi Posi Posi Posi Posi Posi

MAPC tive tive tive tive tive tive tive tive tive tive tive tive tive

Month Low

Effect er

(Mean)

Month Low Low Low Low Low Low Hig

Effect (Var) er er er er er er her

Shaikh A. Hamid, Tej S. Dhakar: Anamolous Behavior of the Volatility of Nasdaq

Composite Index: 1971 To 2017

The mean of absolute percent changes of the second sub-period (1993 to 2002—Table

5) goes up from 0.57% in first sub-period to 1.23% -- more than twice. Markets are

now much more volatile. All the means are significantly greater than zero (p=0.00).

There is no month effect in terms of means of absolute percent changes – none of the

mean of a given month is significantly greater than the mean of other eleven months

stacked. And only April has significantly higher standard deviation (1.54%) compared

to the standard deviation of absolute percent changes of the other eleven months

stacked. So we have seasonality in the second sub-period only in terms of variance –

and not in terms of mean of absolute percent changes.

12