Page 50 - Azerbaijan State University of Economics

P. 50

THE JOURNAL OF ECONOMIC SCIENCES: THEORY AND PRACTICE, V.82, # 2, 2025, pp. 32-60

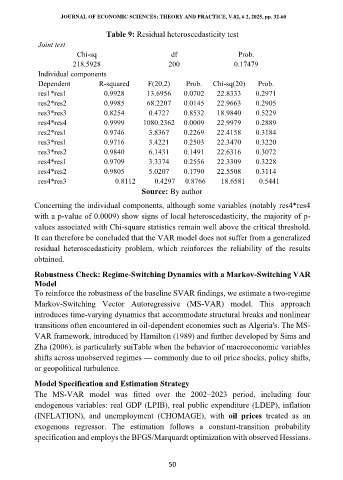

Table 9: Residual heteroscedasticity test

Joint test

Chi-sq df Prob.

218.5928 200 0.17479

Individual components

Dependent R-squared F(20,2) Prob. Chi-sq(20) Prob.

res1*res1 0.9928 13.6956 0.0702 22.8333 0.2971

res2*res2 0.9985 68.2207 0.0145 22.9663 0.2905

res3*res3 0.8254 0.4727 0.8532 18.9840 0.5229

res4*res4 0.9999 1080.2362 0.0009 22.9979 0.2889

res2*res1 0.9746 3.8367 0.2269 22.4158 0.3184

res3*res1 0.9716 3.4221 0.2503 22.3470 0.3220

res3*res2 0.9840 6.1431 0.1491 22.6316 0.3072

res4*res1 0.9709 3.3374 0.2556 22.3309 0.3228

res4*res2 0.9805 5.0207 0.1790 22.5508 0.3114

res4*res3 0.8112 0.4297 0.8766 18.6581 0.5441

Source: By author

Concerning the individual components, although some variables (notably res4*res4

with a p-value of 0.0009) show signs of local heteroscedasticity, the majority of p-

values associated with Chi-square statistics remain well above the critical threshold.

It can therefore be concluded that the VAR model does not suffer from a generalized

residual heteroscedasticity problem, which reinforces the reliability of the results

obtained.

Robustness Check: Regime-Switching Dynamics with a Markov-Switching VAR

Model

To reinforce the robustness of the baseline SVAR findings, we estimate a two-regime

Markov-Switching Vector Autoregressive (MS-VAR) model. This approach

introduces time-varying dynamics that accommodate structural breaks and nonlinear

transitions often encountered in oil-dependent economies such as Algeria's. The MS-

VAR framework, introduced by Hamilton (1989) and further developed by Sims and

Zha (2006), is particularly suiTable when the behavior of macroeconomic variables

shifts across unobserved regimes — commonly due to oil price shocks, policy shifts,

or geopolitical turbulence.

Model Specification and Estimation Strategy

The MS-VAR model was fitted over the 2002–2023 period, including four

endogenous variables: real GDP (LPIB), real public expenditure (LDEP), inflation

(INFLATION), and unemployment (CHOMAGE), with oil prices treated as an

exogenous regressor. The estimation follows a constant-transition probability

specification and employs the BFGS/Marquardt optimization with observed Hessians.

50